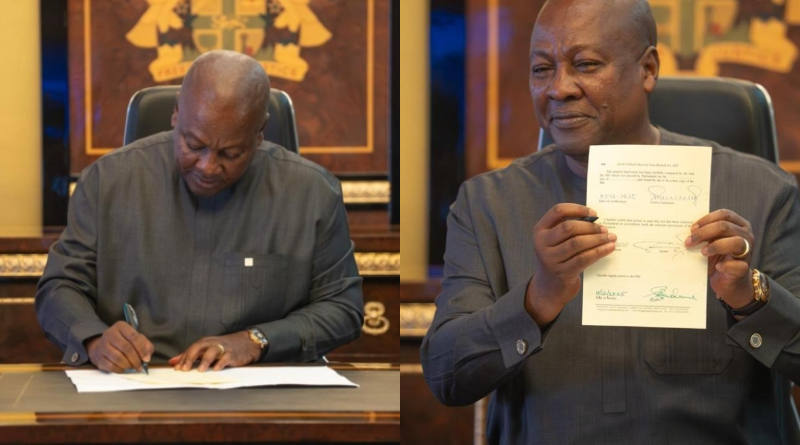

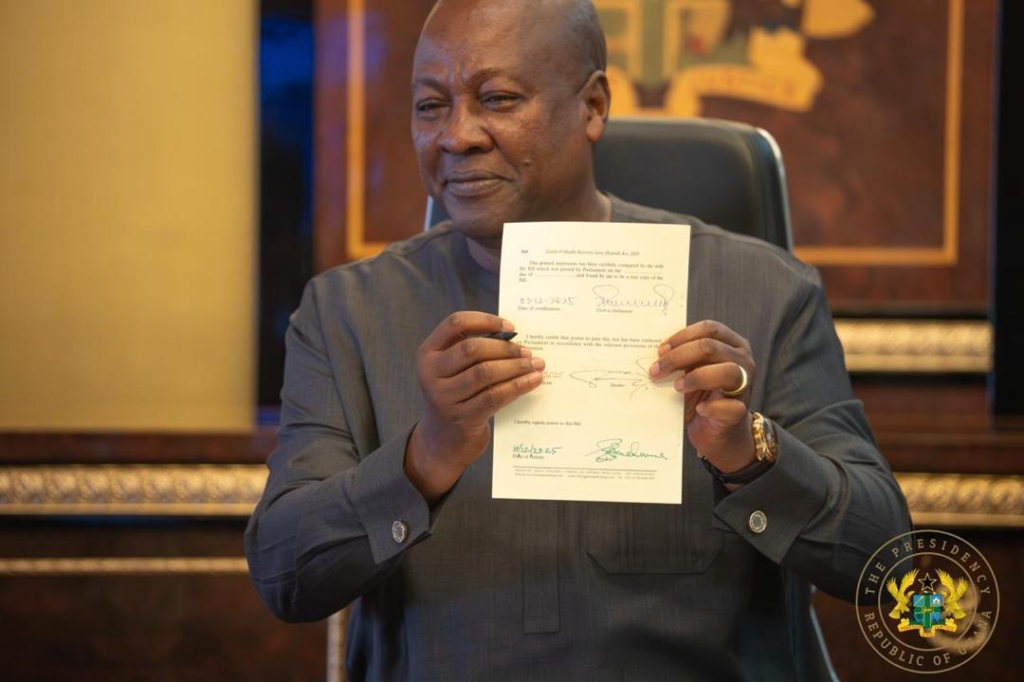

President John Dramani Mahama has formally assented to the COVID-19 Health Recovery Levy Repeal Act, 2025, officially abolishing the one percent levy that has been charged on goods, services, and imports since the height of the pandemic.

The presidential signature, appended on Wednesday, December 10, clears the path for the levy’s full removal starting January 2026, marking a key step in the government’s broader push to ease economic burdens on citizens and businesses.

The repeal comes after Parliament approved the measure last month, reflecting the administration’s commitment to eliminating what it has frequently described as “nuisance taxes.” Government officials argue that removing these taxes will help reduce production costs, lower prices, and offer relief to households already grappling with inflationary pressures.

The COVID-19 Health Recovery Levy was first introduced in 2021 under the COVID-19 Health Recovery Levy Act (Act 1068). Enacted on March 31, 2021, it formed part of Ghana’s emergency fiscal measures during the pandemic. The levy was designed primarily to support health sector recovery, finance COVID-19 related expenditures, and rebuild government fiscal buffers depleted during the crisis.

Under the former Act, a 1% levy was imposed on the value of all taxable goods and services within Ghana, as well as on imports, except for items granted exemption under existing VAT regulations. It became an additional cost borne by both consumers and businesses, particularly affecting sectors heavily reliant on imported goods and production inputs.

With the repeal now signed into law, businesses are expected to adjust their systems in preparation for the levy’s discontinuation in January 2026. Analysts predict that the removal may lead to marginal reductions in the prices of goods and services, depending on how quickly the market responds and whether suppliers pass on the savings to consumers.

Government sources indicate that the decision to scrap the levy forms part of a wider tax restructuring agenda aimed at improving the country’s economic competitiveness. The administration has argued that reducing taxes on consumption and production will stimulate growth, boost investor confidence, and strengthen post-pandemic recovery efforts.

The repeal also carries political significance, as the COVID-19 levy has been a subject of public debate since its introduction. Many business associations, traders, and consumer groups previously argued that the levy added financial strain at a time when citizens were already coping with rising living costs. Its abolishment has therefore been welcomed by sections of the public who see it as a relief measure.

President Mahama’s assent signals a final administrative step in bringing the levy to an end. The Ministry of Finance is expected to issue implementation guidelines to ensure businesses make the necessary system adjustments by the January 2026 effective date.

As Ghana prepares to transition into the new fiscal period, the repeal of the COVID-19 Health Recovery Levy stands as one of the major tax policy shifts of 2025—one aimed at reducing the financial load on consumers while supporting the broader economic recovery agenda.