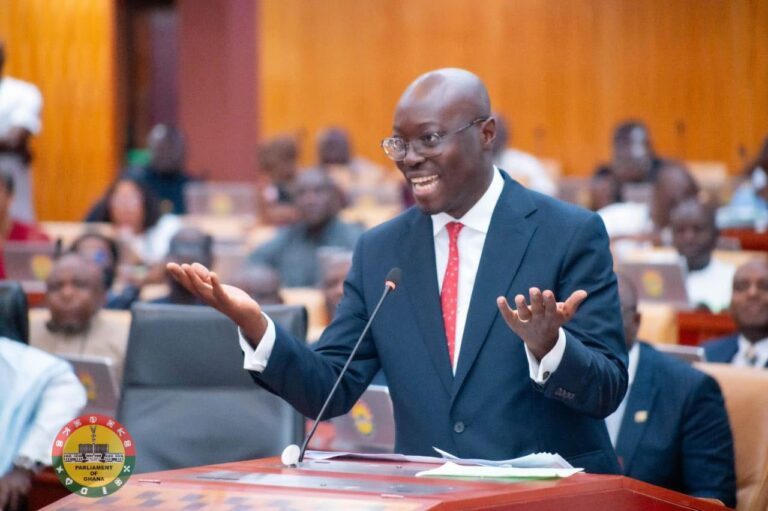

Finance Minister Dr Ato Forson is set to announce a significant reduction in the effective Value Added Tax (VAT) rate to be paid by businesses starting next year.

The move, according to government insiders, will be captured in the 2026 Budget, which Dr Forson is scheduled to present to Parliament later today. The expected reduction forms part of a broader effort to ease the tax burden on businesses and stimulate economic growth.

In addition to the VAT adjustment, the Finance Minister is also expected to announce a comprehensive review of Ghana’s tax laws — a measure some analysts have described as a “total revamp” of the country’s fiscal framework.

“This will be one of the most sweeping reforms since the changes between 2013 and 2016,” a senior policy analyst told JoyBusiness.

Strong indications suggest that the government will scrap the COVID-19 Levy, which was introduced during the pandemic to raise additional funds for health and economic recovery.

Sources close to the Finance Ministry say the move is designed to simplify the tax regime for businesses and improve compliance, which has been a long-standing challenge for Ghana’s revenue authorities.

Beyond tax reforms, the 2026 Budget will focus on measures aimed at expanding Ghana’s economy and creating sustainable jobs. Dr Forson is expected to outline key programmes under the government’s “Big Push” and “24-Hour Economy” initiatives — both aimed at boosting productivity, industrial growth, and employment opportunities.

He will also propose a review of the Public Financial Management (PFM) Act, a move targeted at tightening expenditure controls in the coming fiscal year. The government is further expected to introduce enhancements to the Ghana Integrated Financial Management Information System (GIFMIS) to improve public finance tracking and debt management.

According to insiders, these changes are designed to reinforce fiscal discipline while improving efficiency in the use of public funds.

Dr Forson is also expected to present a detailed roadmap for Ghana’s economic management after the conclusion of its IMF-supported programme. The Finance Minister is likely to stress that the government has managed the economy prudently under difficult circumstances and remains committed to stability, growth, and responsible spending.

Economic analysts predict that the 2026 Budget will adopt a moderate stance on Ghana’s macroeconomic targets, balancing fiscal consolidation with measures to support private sector recovery.

In what could be one of the most closely watched budgets in recent years, Dr Forson’s presentation is expected to highlight policies aimed at:

- Expanding small and medium-scale enterprises (SMEs)

- Reducing unemployment through youth-focused programmes

- Increasing local manufacturing and export competitiveness

- Improving revenue mobilisation through efficiency rather than new taxes

As expectations rise, businesses and industry leaders will be closely monitoring how these proposed reforms translate into real economic relief and growth opportunities in 2026.