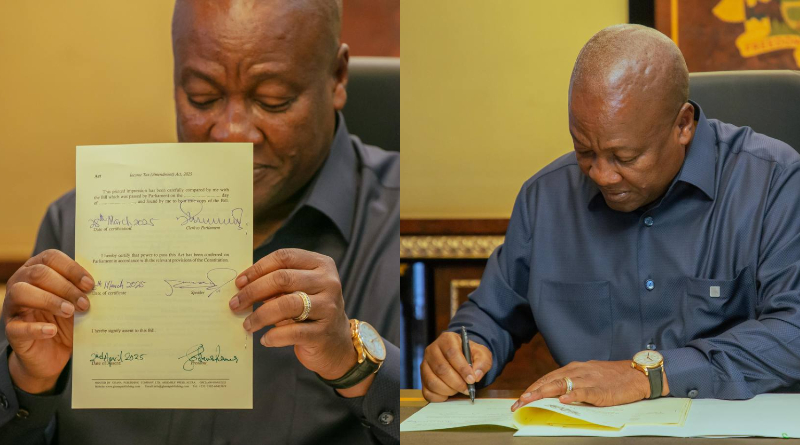

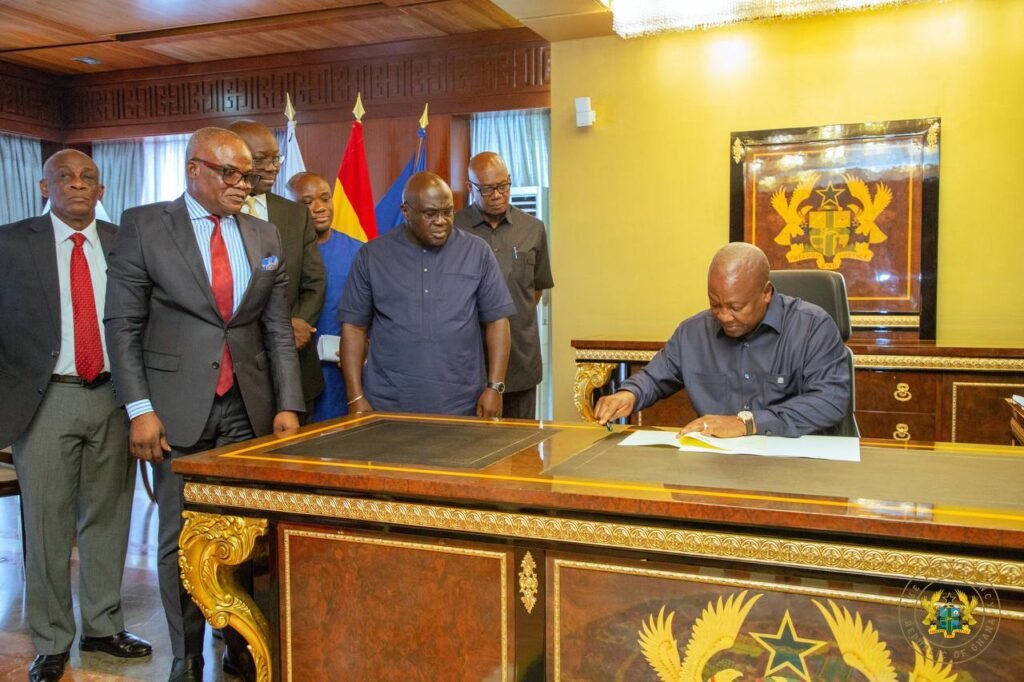

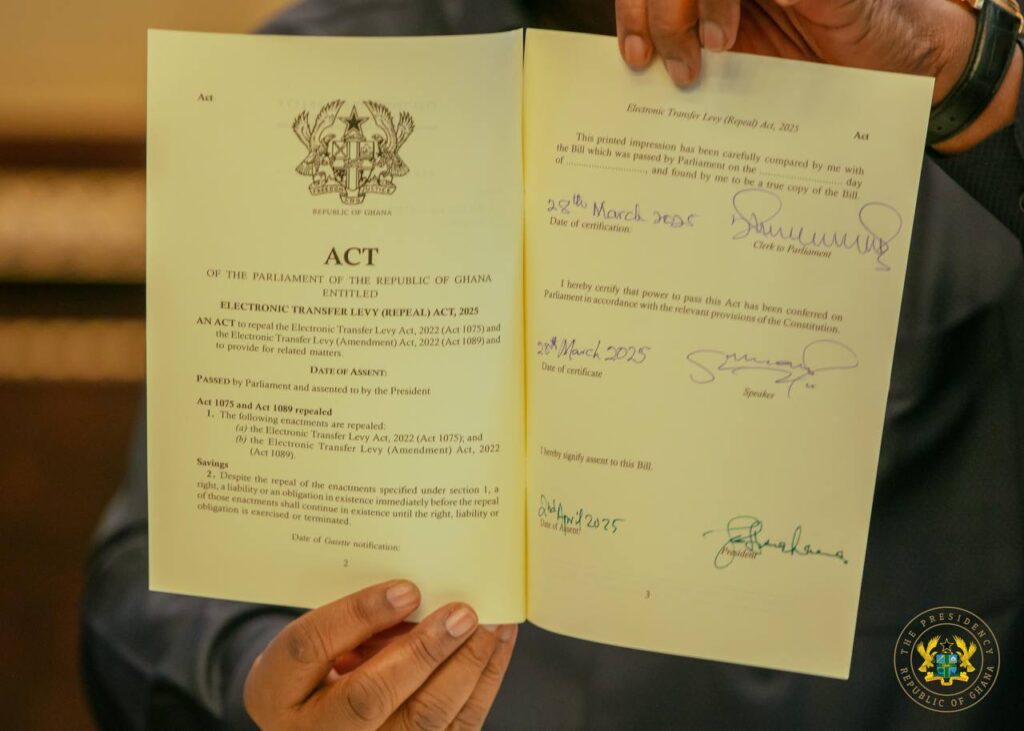

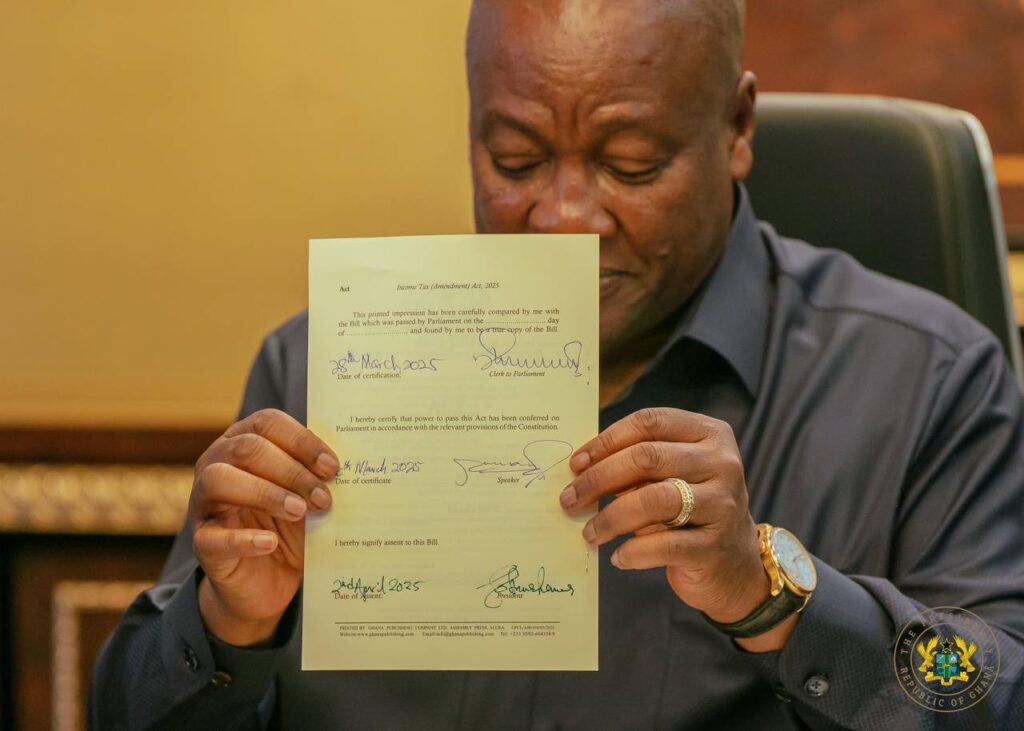

President John Mahama has officially signed bills into law to abolish three major taxes affecting Ghanaians: the Electronic Transfer Levy (E-Levy), the betting tax, and the emissions tax. This move fulfills a key campaign promise he made during the 2024 general elections to reduce the financial burden on citizens.

The decision to eliminate these taxes comes after Finance Minister Cassiel Ato Forson presented the national budget last month, highlighting how these levies were negatively impacting businesses and individuals.

During his 2024 election campaign, Mahama pledged to scrap several unpopular taxes introduced in previous administrations. True to his word, on April 2, 2025, he officially signed the tax repeal bills, bringing relief to many Ghanaians.

Speaking on the matter, Finance Minister Ato Forson explained that these taxes placed excessive pressure on citizens and businesses.

“We recognize the economic hardship these taxes caused. Removing them is the first step in our broader plan to revive the economy and ease the burden on Ghanaians,” he stated.

The three main taxes that have now been scrapped include:

- E-Levy (Electronic Transfer Levy) – This controversial tax charged a percentage on mobile money and electronic transactions. Its removal means cheaper digital transactions for businesses and individuals.

- Betting Tax – Initially imposed on winnings from sports betting and lotteries, this tax was widely criticized, especially by the youth. Scrapping it is expected to boost the gaming and entertainment industry.

- Emissions Tax – This environmental tax aimed at reducing carbon emissions was seen as an additional financial burden on car owners and businesses reliant on transport. Removing it will provide relief, particularly in the transport and logistics sector.

The removal of these taxes is expected to increase disposable income for citizens, stimulate business growth, and encourage digital transactions without fear of excessive charges.

However, economic analysts warn that the government must find alternative ways to generate revenue without overburdening the people. Sustainable economic policies and efficient tax collection strategies will be crucial in filling the revenue gap.

With this bold move, President Mahama’s administration has signaled its commitment to economic relief and growth. The tax cuts mark the beginning of several policy reforms aimed at boosting investment, creating jobs, and improving living standards.

As Ghana moves forward under Mahama’s leadership, citizens and businesses alike will be watching closely to see how these policies reshape the economy and whether additional tax reforms will follow.